Health insurance payroll deduction calculator

This Payroll Deductions Calculator will help you to determine the impact that changing your payroll deductions can have on your financial situation. 2022 Federal income tax withholding calculation.

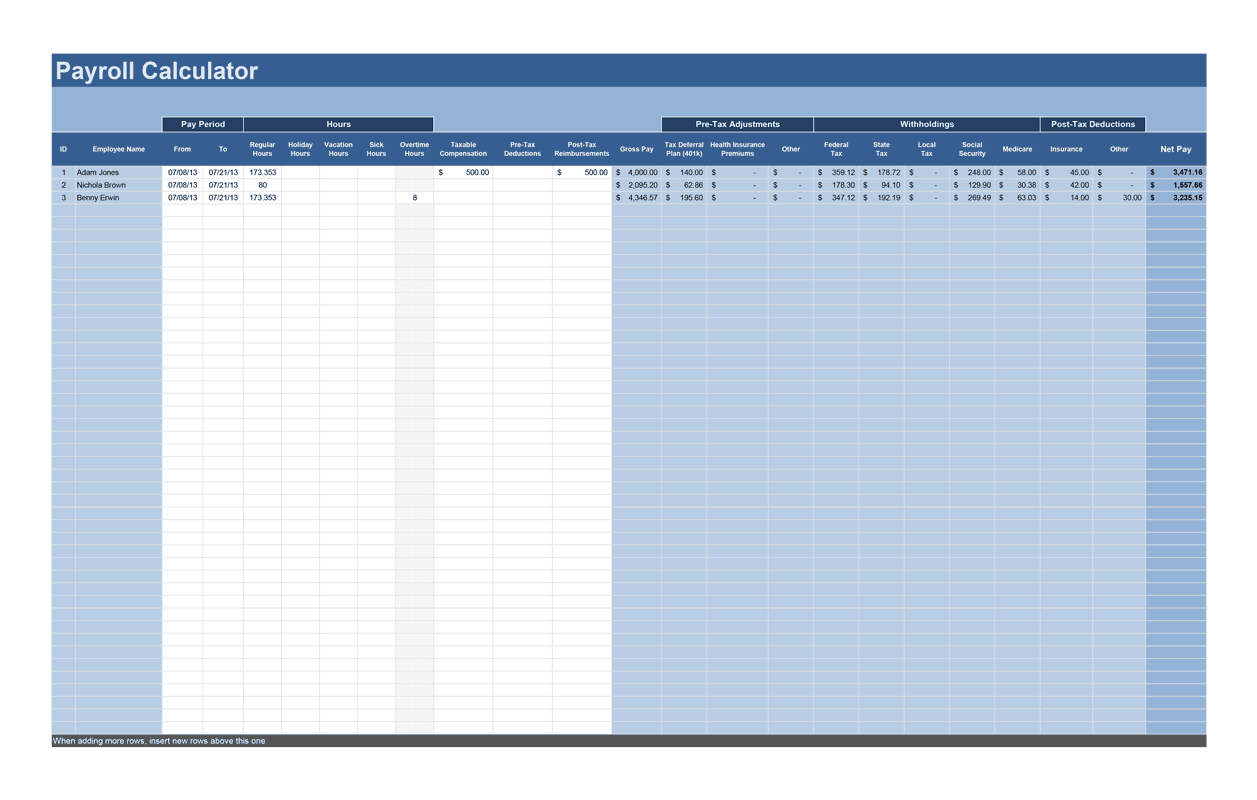

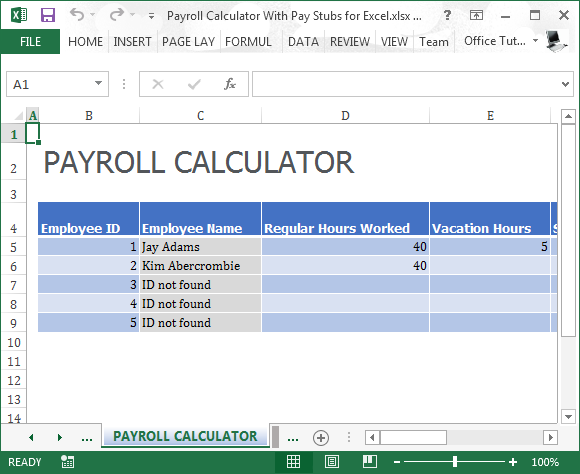

Payroll Calculator Free Employee Payroll Template For Excel

Ad Payroll So Easy You Can Set It Up Run It Yourself.

. Zenefits calculates and pushes. 1547 would also be your average tax rate. Employees paid bi-weekly 26 pay dates a year usually have two pay dates a month but will have three pay dates in some months.

The annual cost is divided by the number of. In these situations the employer pays the insurance company the full premium amount and then the employer is reimbursed by the employee via pre-tax payroll deductions. During the tax year the employer works out the taxable amount of the benefit and adds this to the employees actual monthly pay.

Ad Payroll So Easy You Can Set It Up Run It Yourself. How to calculate annual income. 2022 Federal income tax withholding calculation.

Health Insurance POP etc. It can also be used to help fill steps 3 and 4 of a W-4 form. But thats not always the case.

You can enter your current payroll information and deductions and then compare them to your. This is 1547 of your total income of 72000. Your income puts you in the 25 tax bracket.

Your taxes are estimated at 11139. All Services Backed by Tax Guarantee. Contributions to health vision and dental insurance plans.

Assume that the cost of a companys health insurance plan is 300 per biweekly pay period and that the employee is responsible for paying 25 of the cost through payroll withholding. Select these options from the drop-down. Subtract 12900 for Married otherwise.

Multiply taxable gross wages by the number of pay periods per year to compute your annual wage. Use this calculator to estimate the actual paycheck amount that is brought home after taxes and deductions from salary. Generally health insurance plans that an employer deducts from an employees gross pay are pre-tax plans.

Go to the employees profile. All Services Backed by Tax Guarantee. You can enter your current payroll information and deductions and.

Multiply taxable gross wages by the number of pay periods per year to compute your annual wage. Select on the employee and go to section 5 click Add deduction link. For example if an employee earns 1500.

To calculate an annual salary multiply the gross pay before tax deductions by the number of pay periods per year. An employees contribution to certain health plans may qualify as pretax deductions. Subtract 12900 for Married otherwise.

You can enter your current payroll. While shopping for health benefits. Paycheck Managers Free Payroll Calculator offers online payroll tax deduction calculation federal income tax withheld pay stubs and more.

This calculator uses the 2015. Payroll Deductions Calculator Use this calculator to help you determine the impact of changing your payroll deductions. Use this calculator to help you determine the impact of changing your payroll deductions.

Try changing your withholdings filing status or retirement savings and let the payroll deduction calculator show you the impact on your take home pay.

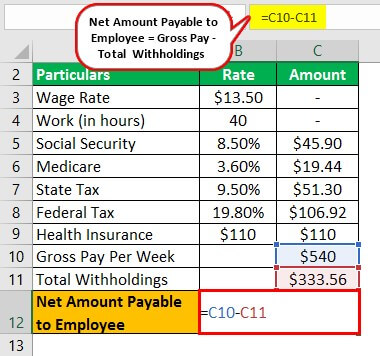

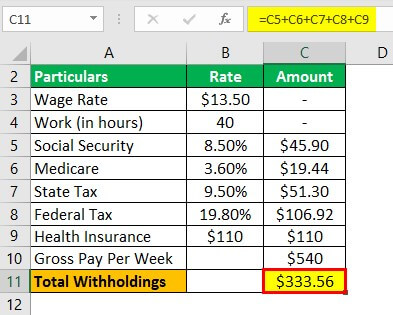

Payroll Formula Step By Step Calculation With Examples

Payroll Calculator Free Employee Payroll Template For Excel

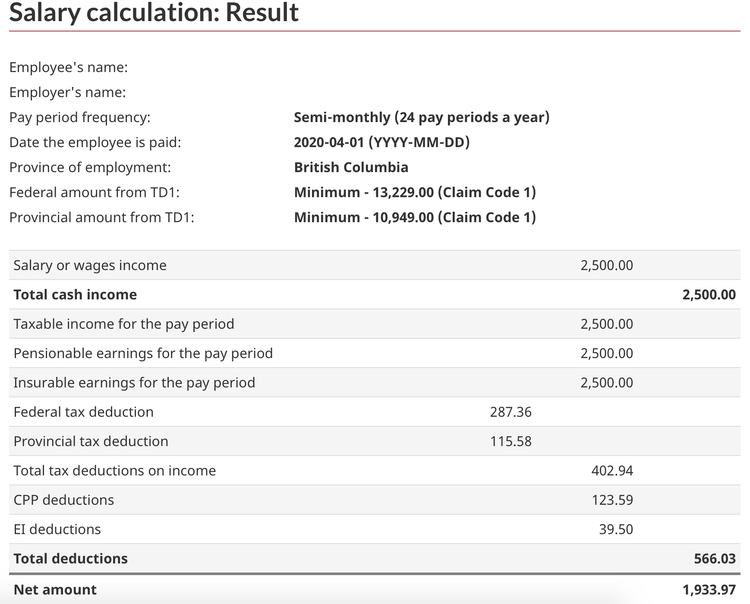

How To Calculate Payroll Tax Deductions Monster Ca

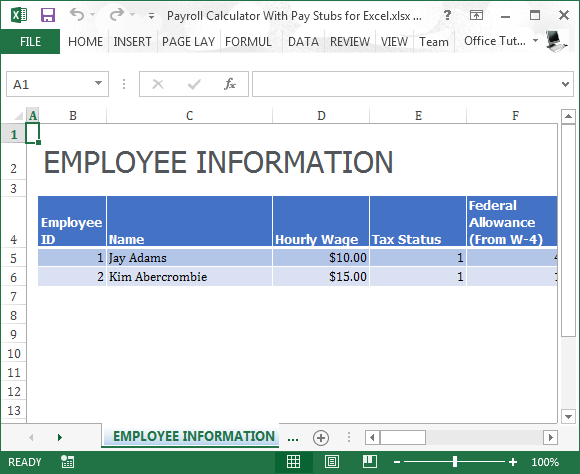

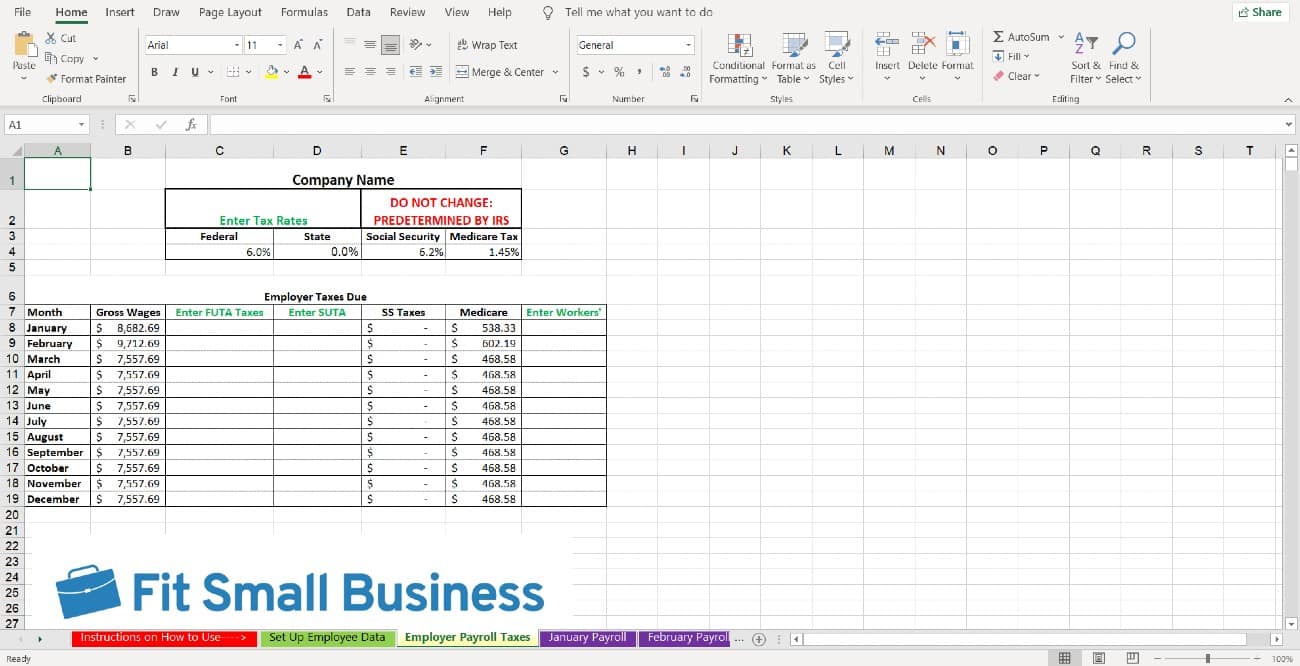

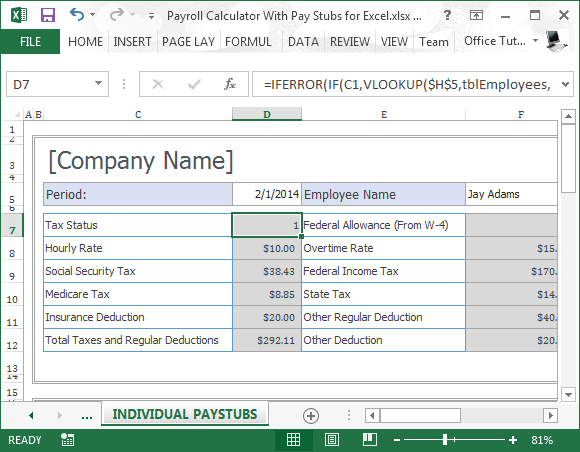

Payroll Calculator With Pay Stubs For Excel

How To Do Payroll In Canada A Step By Step Guide

Payroll Tax What It Is How To Calculate It Bench Accounting

How To Calculate Payroll Taxes Wrapbook

Payroll Calculator With Pay Stubs For Excel

Paycheck Calculator Take Home Pay Calculator

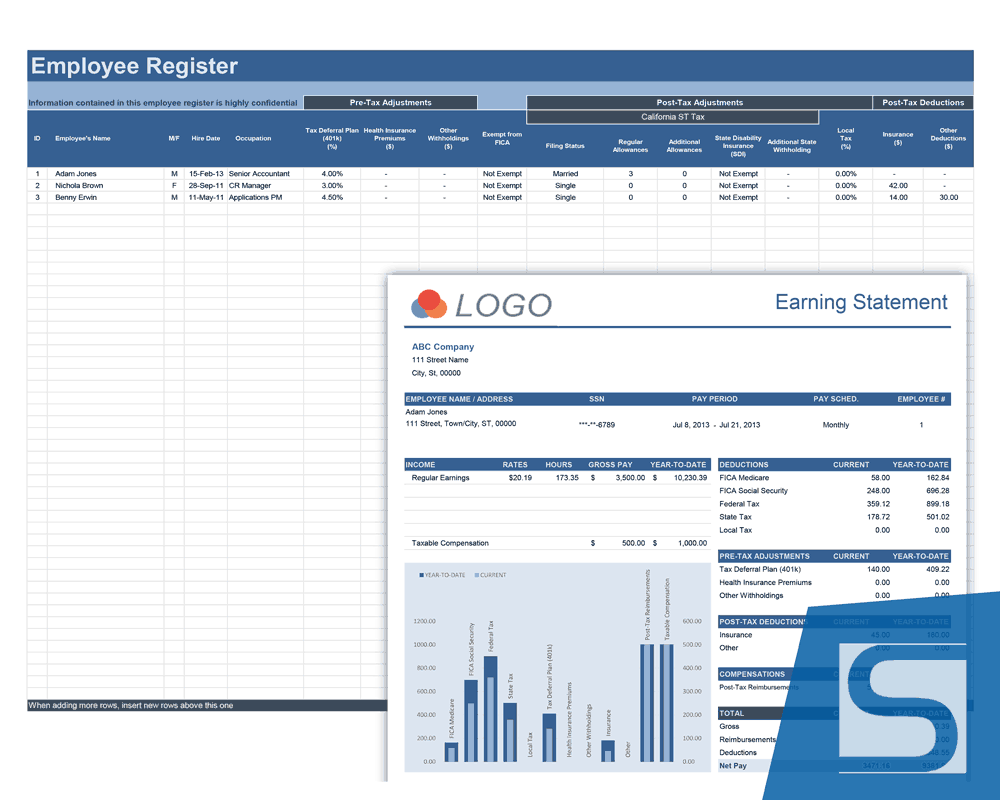

How To Do Payroll In Excel In 7 Steps Free Template

Mathematics For Work And Everyday Life

Payroll Calculator Free Employee Payroll Template For Excel

Payroll Formula Step By Step Calculation With Examples

How To Calculate Payroll Taxes Wrapbook

Different Types Of Payroll Deductions Gusto

Free Online Paycheck Calculator Calculate Take Home Pay 2022

Payroll Calculator With Pay Stubs For Excel